In today’s competitive marketplace, understanding consumer psychology is crucial for marketing success. Consumers are bombarded with choices, and marketers constantly seek strategies to cut through the noise and influence decisions. One powerful tool is loss aversion, a deeply ingrained human tendency to prioritize avoiding losses over acquiring gains. By tapping into this principle, marketers can craft compelling messages that resonate with consumers and drive desired behaviors. Let’s delve deeper into how you can leverage loss aversion to your advantage.

How Cognitive Loss Aversion Works

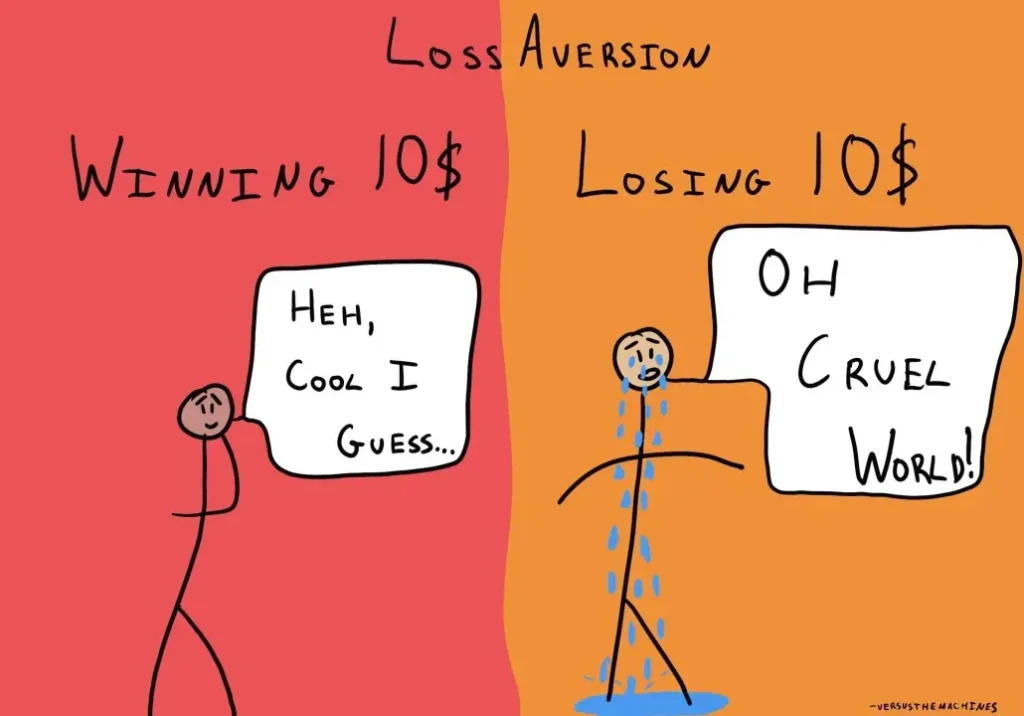

We marketers love touting benefits. But there’s a hidden force that often proves more potent: loss aversion.Behavioral science tells us people are roughly twice as motivated to avoid loss as to achieve gain.

Think about it – that $100 loss stings more than a $150 win feels good. This is the essence of loss aversion.

Loss Aversion vs. Scarcity Bias

It’s important to distinguish loss aversion from scarcity bias. While they’re related, they’re not identical. Loss aversion focuses on our aversion to losing something we already have, be it a possession, a skill, or an opportunity. Scarcity bias, on the other hand, is driven by the perceived value of something that is limited in availability. Scarcity makes things seem more desirable, regardless of whether we already possess them.

Here’s an analogy: Imagine you have a delicious chocolate chip cookie. Loss aversion would kick in if someone threatened to take it away. Scarcity bias would come into play if you saw a bakery selling the last remaining cookie of that flavor. Even if you hadn’t planned on buying a cookie, its limited availability might make it seem more tempting.

The endowment effect adds another layer to loss aversion. Once we perceive something as ‘ours’ (even a potential benefit), we’re more reluctant to give it up. This psychological quirk makes potential losses hit harder but we will tackle this in another article.

Real-World Examples of Loss Aversion in Action

- Duolingo’s Streak Freeze: The popular language learning app Duolingo uses loss aversion through its “streak freeze” feature. Users building a daily practice routine risk losing their streak if they miss a day. This gamified approach capitalizes on the fear of losing the progress they’ve made and the investment of time and effort sunk into building a long streak. Imagine the frustration of seeing your 30-day streak vanish! Duolingo cleverly allows users to “freeze” their streak for a limited time, preventing a single missed day from resetting their entire progress. This feature acknowledges the psychological investment users make in their streaks and gives them a safety net to quell the fear of loss.

- HotelTonight’s “Tonight Only” Deals: HotelTonight, a mobile app specializing in last-minute hotel deals, leverages loss aversion with its “Tonight Only” offers. These limited-time deals tap into our fear of missing out (FOMO) and the potential regret of finding out a great deal disappeared overnight. Let’s say you’re planning a spontaneous weekend getaway and browsing HotelTonight. You see a fantastic deal on a luxury hotel room, but it’s only available for that specific night. The “Tonight Only” label creates a sense of urgency, encouraging you to book before the deal vanishes. This tactic plays on our aversion to missing out on a chance to save money or experience something special.

- Gym Membership with a “Pause Option”: Many gyms understand the power of loss aversion. They offer memberships with a “freeze” feature, allowing users to temporarily pause their membership for a set period (e.g., during vacations or busy times). This caters to the fear of losing gym access and the progress made towards fitness goals. Imagine someone who’s faithfully attended the gym for months, building a solid workout routine. The idea of losing that momentum due to a temporary break can be a powerful deterrent to canceling their membership entirely. The “freeze” option provides a safety net, acknowledging the investment of time and effort members put into their fitness journeys and addressing their fear of losing the progress they’ve made

- Boosting Retirement Savings with Loss Aversion: A major financial services company wanted to motivate employees to boost their retirement contributions. Their audience was diverse – some felt financially stretched, others felt complacent with their savings. How do you address both mindsets?The marketing agency tested multiple strategies:

- Social Proof: Highlighting what similar employees were saving

- Scarcity: Emphasizing money-saving secrets

- Loss Aversion: Cautioning against financial mistakes

While all tactics performed well, the loss aversion-based subject line – “Do you make this money mistake?” – consistently drove the highest open rates across age groups and financial situations. The fear of making a misstep was a powerful motivator, regardless of whether someone felt financially insecure or confident.(N Harhut: 41)

Why Loss Aversion Matters for Marketers – Academical Research

For marketers, the implications are profound, influencing how products are promoted, how sales are structured, and even how brands communicate with their audience.

The significance of loss aversion was first introduced through Prospect Theory by Daniel Kahneman and Amos Tversky in 1979. Their work, which later earned Kahneman the Nobel Prize in Economic Sciences, revolutionized our understanding of how decisions are made under risk, challenging the traditional economic assumption that humans are rational actors. Kahneman and Tversky found that individuals value gains and losses differently, leading to decision-making that often departs from logical expectations. This insight is crucial for marketers aiming to tap into psychological triggers to influence consumer behavior.

A more recent study led by Kai Ruggeri at Columbia University’s Mailman School of Public Health expands on these findings by testing Prospect Theory on a global scale, involving 19 countries and 13 languages. This study is pivotal as it confirms the theory’s generalizability and relevance in today’s diverse global market.

The research underscores that the fear of losing $100 is more powerful than the opportunity to gain the same amount, a phenomenon observable across different cultures and economic environments. (1)

For marketers, understanding and applying the concept of loss aversion can dramatically impact consumer response to advertising, product offerings, and brand engagement strategies.

Supporting these strategies, academic research beyond Kahneman and Tversky’s foundational work continues to explore the nuances of loss aversion in different contexts, including digital marketing, consumer goods, and even health behavior change. Studies have shown that loss-averse framing in advertisements and messaging can significantly increase engagement and conversion rates.

For example, ads emphasizing what is lost by not using a product (e.g., “Don’t miss out on this opportunity”) are more effective than those that focus solely on what can be gained. (2)

How to Leverage Loss Aversion Across Channels

Is time to be practical my reader, and in that sens, leveraging loss aversion effectively across different marketing channels requires a nuanced approach that understands the unique dynamics of each platform while tapping into the psychological underpinnings of consumer behavior. Here are strategies tailored to various channels:

Email Marketing

- Scarcity in Subject Lines: Use subject lines that communicate scarcity or a limited time offer, such as “Last Chance!” or “Only a Few Left!” This approach encourages opens and actions before the opportunity is missed.

- Personalized Loss Aversion: Send personalized emails highlighting what the subscriber might lose by not taking advantage of a specific offer or update, based on their past behavior or purchase history.

Social Media

- Engaging Stories and Posts: Use stories on platforms like Instagram and Facebook to highlight limited-time offers or exclusive deals that create a sense of urgency. Visuals of sold-out products or testimonials from customers who benefited can amplify the fear of missing out.

- Interactive Polls and Q&As: Engage users with polls or questions that highlight the benefits they would miss by not choosing your product or service, making the loss more tangible and immediate.

Website Optimization

- Countdown Timers: Implement countdown timers for special promotions or the release of new products to visually represent the window of opportunity closing.

- Exit-Intent Pop-Ups: Use exit-intent technology to present a message or offer that highlights what visitors would lose by leaving the site without taking action, such as a discount or access to exclusive content.

Content Marketing

- Case Studies and Blogs: Publish content that details what customers have lost by not using your product or service and how they benefited once they made the switch. This real-life evidence can make the concept of loss more relatable and convincing.

- Infographics: Create infographics that visually represent the benefits lost by not choosing your solution, making the abstract concept of loss aversion more concrete and understandable.

Paid Advertising

- Ad Copy: Craft ad copy that emphasizes the negative consequences of not taking action, such as “Don’t Waste Another Minute” or “Stop Losing Money on Inefficient Solutions.” This can increase the click-through rate of your ads.

- Retargeting Campaigns: For users who have visited your site but didn’t make a purchase, retargeting ads can remind them of what they’re missing out on, reinforcing the loss aversion message.

E-commerce

- Stock Indicators: Show low stock alerts on product pages to emphasize scarcity and encourage immediate purchases.

- Loyalty Program Expirations: Remind customers of points or rewards that are about to expire, motivating them to make a purchase to avoid losing their accumulated benefits.

Across all channels, it’s crucial to balance the use of loss aversion with positive messaging. Overemphasis on loss can lead to negative brand perceptions or decision paralysis among consumers.

The key is to create a sense of urgency without resorting to fearmongering, offering a clear path to avoid the loss by taking a specific, beneficial action.

This balanced approach ensures that the psychological trigger of loss aversion is used ethically and effectively, driving engagement and conversions while maintaining a positive brand image.

This is the end my reader….

To conclude, here’s a concise recap video on Loss Aversion by Daniel Kahneman, thoughtfully prepared by DenkProducties

A Critical Reminder for Marketers: The Ethical Use of Loss Aversion

Understanding the psychology behind loss aversion opens the door to a potent persuasive tool in marketing. It’s a strategy that can significantly influence consumer behavior by highlighting what they stand to lose by not choosing your product or service. However, wielding this power comes with a responsibility to avoid manipulative tactics that prey on consumer fears.

Instead, focus on showcasing how your brand can genuinely prevent problems or ensure your customers don’t miss out on valuable opportunities. It’s about adding real value to your customers’ lives, not creating unfounded fears.

I’m curious to hear about your experiences. Have you integrated loss aversion into your marketing strategies? What outcomes did you observe? Let’s start a conversation in the comments below about responsible marketing practices and the impact of psychological insights on our campaigns.

References:

- N. Harhut: Using behavioural science in Marketing

- D. Kahneman , Amos Tversky and Paul Slovic – Judgement under uncertainty_ Heuristics and Biases

- R. Cialdini: Influence

- D. Ariely: Predictably Irrational

- (1) https://www.publichealth.columbia.edu/profile/kai-ruggeri-phd

- (2) https://www.sciencedaily.com/releases/2020/05/200518144913.htm